About Us

Description

We are an independent, Ontario-based investment management firm registered as a Portfolio Manager and Investment Fund Manager with the Ontario Securities Commission.

We manage investment portfolios on behalf of private clients, corporations, and partnerships.

How we may Differ

We differ from mass-market or retail investment managers as we manage larger amounts of money for fewer clients and charge a lower management fee. We do not sell investment products but rather, independently and free from bias, purchase investments in the best interests of our clients.

We manage accounts primarily on a discretionary basis (you grant us authority to make investment decisions without prior approval from you for each transaction). As a discretionary Portfolio Manager we have a fiduciary duty to act with care, honesty and good faith, always in the best interest of our clients. As fiduciaries, securities regulation requires the highest level of education and experience in the investment industry.

Client Profile

Our Private Client's (across family accounts and personal holding companies) generally have portfolios in the $250,000 to $5,000,000 range. Most heads of households are either active-earners (executives or business owners) or have estate-sized retirement accounts. Our corporate and partnership account sizes are in excess of $1,000,000.

How we are Compensated

Our fee is transparent and generally much less than retail financial service operations. We do not receive commissions but rather portfolio management fees are charged as a percentage of portfolio value. We do well when you do well.

It's important to note that your money must reside at a custodian financial insitution for an extra layer of protection and safety. There is usually a small additional fee for this service, though we currently have arranged custodial services with select providers for no additional fee.

Communication

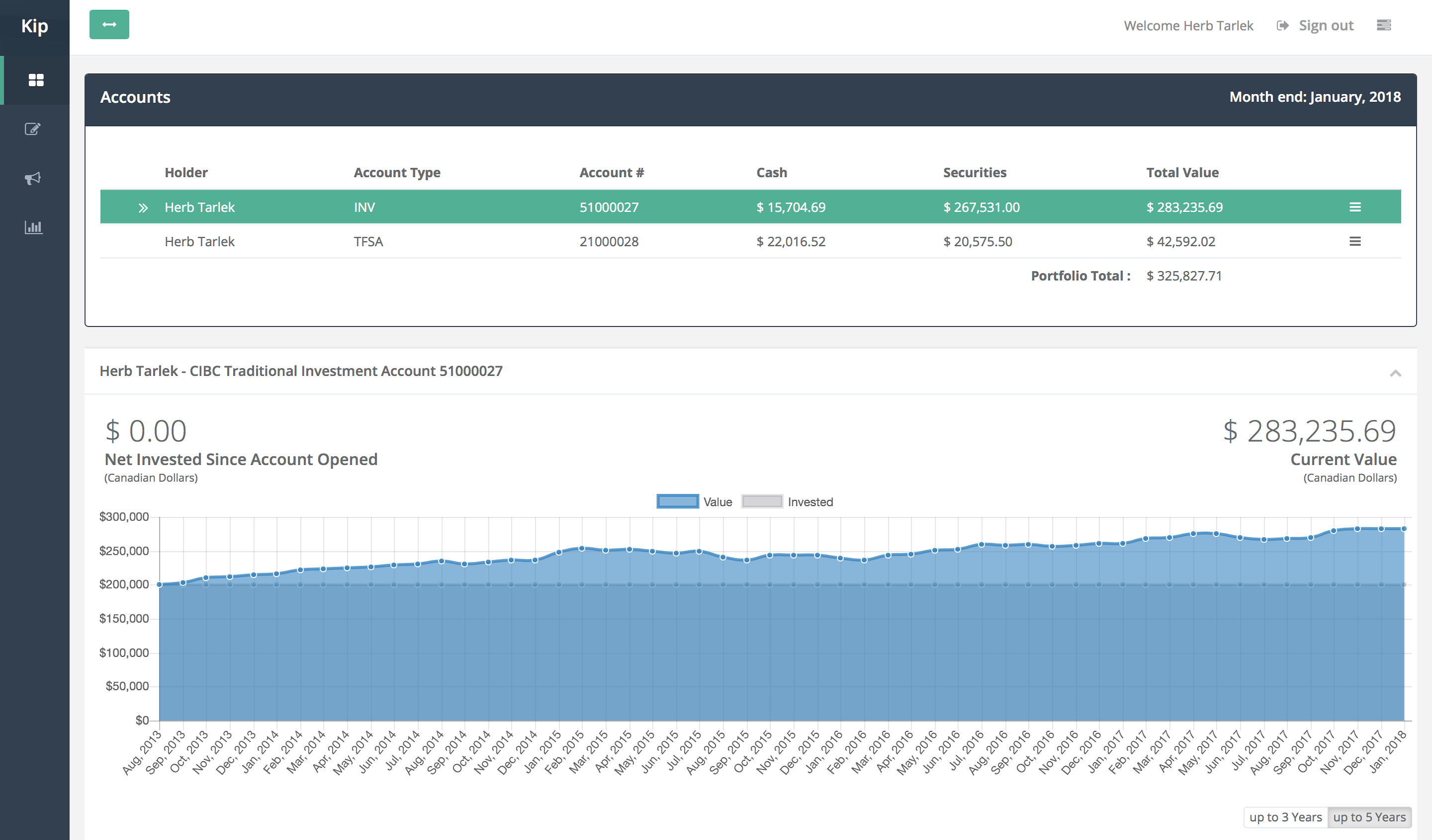

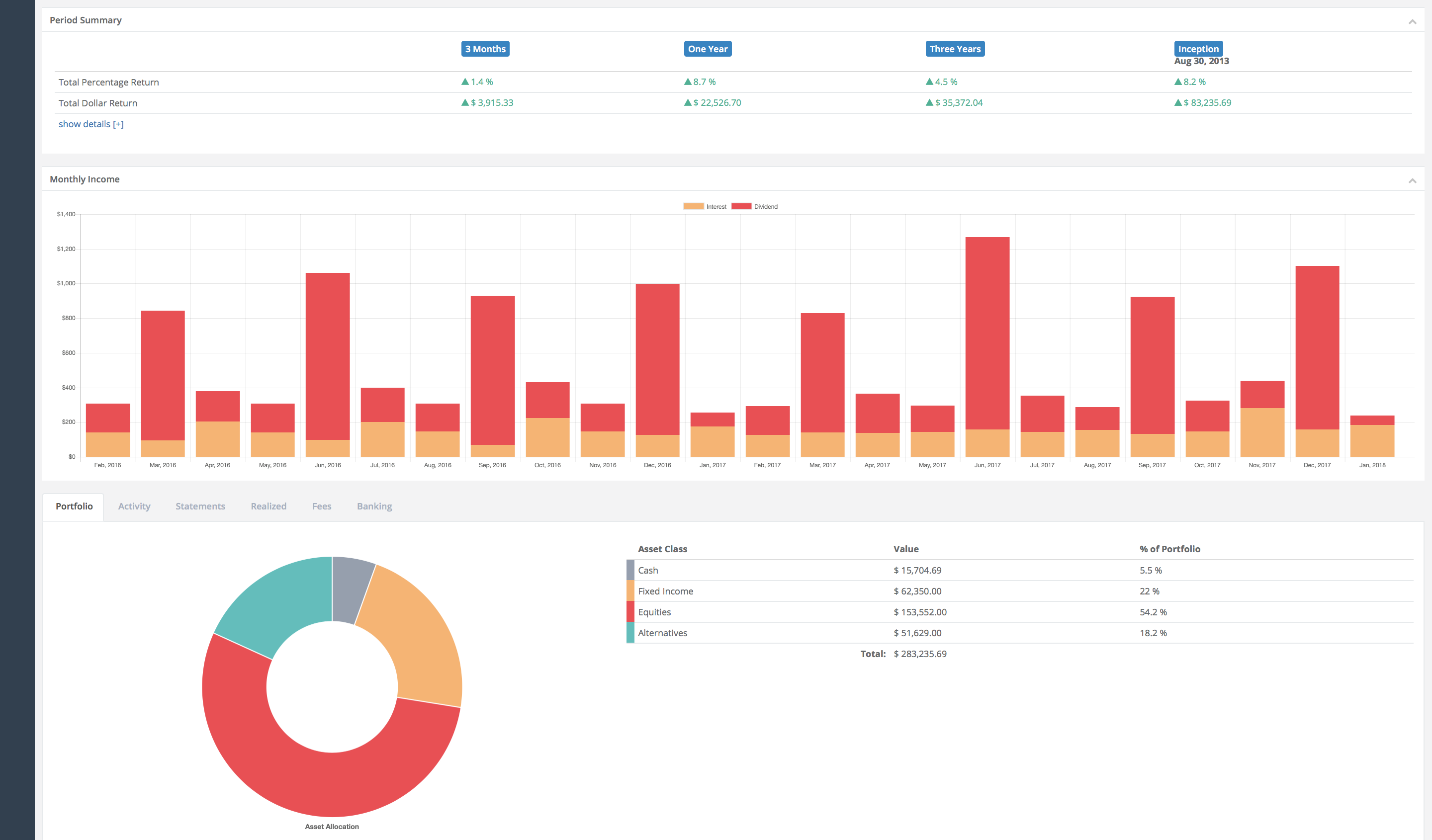

Well Designed and Clear Reporting

We have designed our web application based upon client surveys, feedback and our own experiences with other platforms. The goal is to simplify reporting where possible to clearly communicate frequently saught information in a digestable form.

We employ a digital-first philosophy. We adamently avoid paper-based communication as much as possible to improve access, accuracy, timeliness, depth of information, and quality of service.